Military Supply Chain Providers Need To Plan And Budget Carefully

Defense contractors that make up the #military supply chain are an incredibly diverse group of businesses.

Though media and policy-makers often focus on the largest prime and sub-contractors that are the drivers for producing weapon systems, aircraft, ships, vehicles, and other tools that support the war fighter, there are tens of thousands of other businesses, many of which are small and mid-sized companies (#SMBs), that make up the supply chain ecosystem.

One of the greatest challenges impacting all companies, especially given the government’s changing posture on sequestration (Lawmakers: Sequestration is here to stay, March 2015 – CBO Confirms: No Sequestration in Fiscal 2016, January 2016 – Sequestration Budget Cuts Pose ‘Greatest Risk’ to DoD, March 2016), is the management of production and personnel on contracts.

When military contracts face delays, cuts in funding, or increases in funding, there is a ripple effect on manufactures.

Sara Sorcher wrote an article for Defense One a few years ago (Sequester and the Supply Chain: ‘Life or Death’ for the F-35’s Small Companies) that focused on how small companies involved in the production of the F-35 Joint Strike Fighter were impacted by sequestration. By Sorcher’s estimate, there were approximately 600 small businesses involved in the project – many of whom could be impacted by cuts to orders. Fewer planes or delays in needed parts for planes impact companies that make everything from nuts and bolts to antennas, metal and glass for components, and more.

Of course, the F-35 is the most expensive weapon system the military has ever purchased. So, it is logical that the negative impact from cuts and delays would be far-reaching. However, it is not just big contracts that impact SMBs.

Given the thin margin of error many SMBs have when entering into government contracts, cuts or delays to programs that seem small by comparison to a big project can have long term repercussions to a company’s bottom line.

What’s more, cuts or delays can force some companies to raise costs to compensate. This will undoubtedly have an impact on program funding, increasing costs to the taxpayer. Cost increases also may potentially harm a SMBs ability to win future contracts.

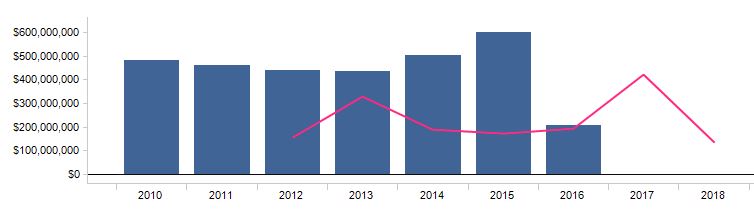

[graphiq id=”aoJh7czTuuN” title=”American Military Expenditure Over Time” width=”600″ height=”512″ url=”https://w.graphiq.com/w/aoJh7czTuuN” link=”http://country-facts.findthedata.com/l/1/United-States” link_text=”American Military Expenditure Over Time | FindTheData” ]

It Is Important To Always Evaluate Your Supply Chain Risk

At ISO Group, we understand the nature and complexity of the military supply chain. One of the areas we focus on with clients is to help how they can manage their supply chain risk.

Through our #Defense Logistics Management System (DLMS™), which is a proprietary database of over 125 million part numbers and 12,000 certified suppliers, we can provide companies with data on part order histories over many years as well as current buying trends. This data allows our clients to better understand which parts are in need or may be coming into need.

There also is the matter of cost. ISO Group’s DLMS also keeps a pricing history, which further enhances your ability to evaluate the opportunity and assign realistic revenue goals for your business.

It is critical for all companies in the military supply chain to constantly be planning and evaluating data on what the government is buying or where there may be program delays. This will help to not only prepare for shifts in capital or personnel needs, but also could allow you to identify other areas of opportunity.